What grocery, restaurant brands, and consumers are learning from COVID-19

Transformational shift in consumer lifestyle habits and retailers’ brand experience

First of all, THANK YOU to all the front line workers, including those at grocery stores and restaurants at this unprecedented time. You have provided all of us with the opportunity to be able to enjoy food and meals with our loved ones and families during this difficult period. Your efforts don’t go unnoticed!

As I think about how the quarantine has changed consumers’ perceptions and lifestyles relating to many different areas of our daily life (work, education, shopping, entertainment, fitness, etc.), I thought I’d share a perspective on how this might impact the future for grocery retailers and restaurants. This time has changed our shopping habits, food delivery, meals with others, pick-up and on-the-go ordering and even the packaging of food and other products.

I know many consumers are leveraging technology, perhaps for the first time, ordering online or on their mobile phone, picking up in store, curbside and/or having it delivered. Prepared food brands like Blue Apron have grown 300 percent this past month (after losing almost 60 percent market value in 2019). Hello Fresh has grown 40 percent year-to date. DoorDash, Grubhub, and UberEats are growing once again after struggles with obstacles the past six months from restaurants based on their high commission structure.

For many, some of these experiences will be for the first time (new adopters) or for others who were already technology savvy, our current situation has forced them to do this more often. So, what habits will stick in the future? What will change or evolve? What perceptions have been created about brands and their response to all of this? Has this new norm been favorable or unfavorable?

Some retail brands have responded to the challenge well. Kroger recently launched a pick-up only location to make it easier for shoppers to get groceries while limiting customers’ potential exposure to the coronavirus. Panera Bread restaurants, like other fast-casual brands are offering groceries to order and food delivery. Other brands like Walgreens are leveraging their drive-thru to expand the usage beyond dropping off and picking up a prescription. What could other brands learn from this?

In the future, consumers will more than likely shift their purchase habits based on this recent experience. For example, because of the shortage of toilet paper, tissues, cleaning products etc., consumers have gone online to purchase these from retailers they would not normally consider. Many consumers already order staple items like these online via a replenishment program. In the future, will e-commerce grow even more rapidly because of this current experience where consumers feel more comfortable about this and actually enjoy it? I see many categories being affected by this, such as pet food, bulk beverages, and other items.

Brands will need to envision a new retail experience for the future in order to differentiate their brand proposition to remain competitive and to deliver on consumer trends.

This change will cause the need for a new supply chain model to be accelerated at a faster pace than what might have already been planned by some retailers. The role of the store will also need to continue to evolve. Transform the front-of-house and rethink the back-of-house to meet consumer demands and provide a more efficient distribution and delivery system. More efficient distribution centers are needed to facilitate the rise in e-commerce and delivery increase to stores and to customers. Many retailers will need a more efficient method, especially in urban areas for last-mile delivery, which will be important for retail brands to compete against Amazon and others.

Many consumer trends that were identified before the COVID-19 situation will not go away, but rather many of them will become accelerated, such as convenience, personalization/customization, integration of mobile/digital with the physical store experience, BOPIS destinations, etc. Convenience is a key area where many grocery and restaurant brands will need to rethink their offering. Since COVID-19 put restrictions for many restaurant and grocery brands in many states where they had to stop build-to-order food offerings (custom made sandwiches, meals, etc.), while still being allowed to sell pre-packaged food express/convenient offerings. In the future, both of these offerings will still be needed, although express/convenient offering will continue to grow. This affects the supply chain, delivery model and how this offer is presented or merchandised in store.

In summary, there are five key learnings in response to COVID-19 for retail brands:

- Rethink the supply chain for the new retail economy with a focus on a new channel for delivery providing more convenience for consumers while driving efficiency for the retailer.

- Transform the retail environment for shoppers – For grocery, how can the store become a destination for specific experiences, while strengthening their e-commerce business? For restaurants, how can they become more innovative with a retail offer in store, while innovating their to-go experience?

- Reimagine the role of the store – Transform the front-of-house and rethink the back-of-house to meet consumer demands and provide a more efficient distribution and delivery system.

- Leverage existing real estate assets and innovate to provide a better customer experience and differentiator for the brand – Parking lot, drive-thru, BOPIS destinations all can be reimagined.

- Integrate digital with the physical store – Innovate the consumer experience by providing meaningful mobile apps, RFID technology for the elimination of check-out and other processes, in-store communication and integration with mobile and other digital experiences.

Park Avenue Seasonality

A few weeks ago, I was staring out the window of a NYC Taxi trying not to wince as we almost got flattened by a truck, and a bright yellow awning emblazoned with the word “summer” in bold, capitalized letters grabbed my attention. I caught a glimpse through the window as we whizzed by and had a vague impression of an interior dripping with vibrant plants, but before I could get a really good look we were off again.

My curiosity was piqued and as soon as I was back on solid ground I was furiously searching the internet for more information. Imagine my surprise when I discovered the location was a truly seasonal concept from Michael Stillman, formerly of Smith & Wollensky, and the concept was a revival and reimagining of the Park Avenue Café which had enjoyed a 22-year run on the Upper East Side.

The concept is completely seasonal, changing everything from the menu, décor, and details down to the business cards for each of the four seasons – Spring, Summer, Autumn, Winter. The Summer menu is stuffed with light, sweet options like Strawberry Gazpacho and a Maine Lobster dish with pickled peppers, while the décor gives off a warm, comforting glow reminiscent of the sky at sunset.

The Autumn season, on the other hand, gives off classic crunchy leaves and hearty, spirit warming meals – like their famous Broccoli and Cheetos Soup (yes, you read that right, Cheetos) and Sticky Toffee Pudding.

It’s a concept that gives new meaning to the idea of “seasonality.” Clearly, the team behind the restaurant knows what they’re doing as visitors are drawn to revisit the location every few months to see what the new season has brought for them. They also do an excellent job of building up excitement for the new season through their social media channels. Once the time comes for the transition, they close for three days, black out all of the windows, and then reopen with the completed transformation – ready for guests to immerse themselves in the fresh season.

The idea of seasonality behind this restaurant isn’t necessarily new to Millennials, they’ve gotten used to constantly changing inventory and curated collections from brands like Zara and pop-up experiences across the retail industry. Even in the restaurant industry, we’ve been slowly conditioned to expect a certain amount of exclusiveness. Consider, for example, the rise of popularity in food trucks and promotional pop-ups during the holiday season. But, the idea of a permanent location that changes not only the food, but also its entire brand presence and recognizable elements is new for the category.

There are potentially some broader implications for the entire retail industry as we see consumers continuing to look for new and differentiating experiences. In the future, we could conceivably see the in-store design change right next to the clothes they’re selling. Can you imagine walking into Target one morning and seeing everything from the wall color to the carpet tiles and the clothing racks suddenly immersing you completely in the feeling of the season?

Image Credits: The Village Voice, Gothamist, and Park Avenue

Office Lovin’: A Look Inside Windward’s New Harrisburg Office

When conceptualizing the new space, Windward expressed the importance of catering to its employees’ different work styles. The NELSON team prioritized the introduction of huddle rooms and phone booths that can also serve as personal office space. The large outdoor patio accessible through the multifunctional café provides opportunities for collaboration and socialization. It is also equipped with WiFi and the appropriate electrical connections for outdoor working.

West Georgia Technical College New Carroll Campus Recognized with 2023 Georgia ACI Dan Brown Award

We’re excited to share that our project with West Georgia Technical College New Carroll Campus has received an Outstanding Achievement Award in the Low Rise Buildings Category in the 2023 Georgia ACI Dan Brown Awards. Thank you to our talented teammates and partners!

Our Return to the Great Outdoors: Fueling the Outdoor Lifestyle

From retail destinations, office amenities, new services, and sustainable design, we’re seeing a surge in the desire to reconnect with the great outdoors across every consumer-facing environment. In our latest series, Our Return to the Great Outdoors we’ll share how brands can embrace this trend to create both safe and memorable outdoor experiences that will resonate with consumers long after COVID-19 fades.

In times of uncertainty, consumer expectations don’t change completely—they simply evolve, pivot and accelerate, raising the bar and amplifying the demand for new, relevant experiences. In 2020, a major shift in consumer behaviors welcomed an uptick in outdoor recreation. With health in mind and a new appreciation for wide open spaces, consumers and developers have turned their focus to sustainable environments that are connected to nature. In the third and final part of this series, we’ll be exploring elements that enhance this connection through amenities, services, or new standards:

Outdoor Activities

According to Outdoor Industry Association, Americans have flocked to outdoor recreation amid COVID-19 restrictions limiting indoor experiences. Across the country, hiking and camping sites have reported their busiest months in years, and according to the N.P.D Group, the sales of leisure bikes have jumped 121 percent. With this at play, it seems active, outdoor lifestyles are here to stay. There are many ways brands and businesses across all sectors can create environments that this complement trend including adding bike repair shops and storage to properties or introducing outdoor focused products/services.

Seasonal Solutions

As the seasons change and COVID-19 remains, brands and business will have to adjust to new weather. Even with safety concerns, many consumers will want to continue shopping in-store, dining out, and enjoying the outdoors. For restaurants, outdoor spaces will have to be winterized and property managers will have to develop outdoor amenities that that support year-round engagement (e.g. Astroturf, outdoor fire pits, or green space that can be a pop-up playground in the summer and an ice rink in the winter).

Simulating the Senses

Even for completely indoor environments, there are many ways the outdoors can be brought inside to cater to consumers new found appreciation of nature. This can be accomplished by:

- Adding sound machines, greenery, and natural materials to a space, whether it is part of a shopping, living, or working environment

- Creating environments that have greater access to natural light or easy access to the outdoors via doors and functional windows

- Prioritizing WELL-Certified environments to build more sustainable spaces that promote overall health and wellbeing

AIS Headquarters

Overall, consumer behaviors prove that outdoor spaces are worth the investment. Whether it’s incorporating amenities and resources to make outdoor activities more assessible, creating flexible spaces that can easily be transformed for seasonal outdoor use, or adding outdoor flair inside, give consumers what they want and help them better connect with the great outdoors.

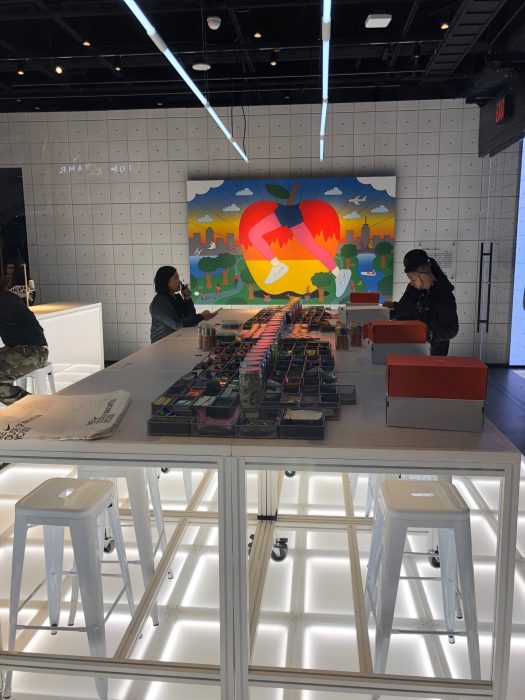

Nike’s New App-Fueled Flagship

Nike’s newest flagship store has opened its doors on Fifth Avenue NYC. The 68,000 square foot, six-story flagship paves the way for future retail and transforms the way people shop for their favorite Nike sneakers and apparel. Fueled by Nike’s mobile app, the “House of Innovation 000” store allows shoppers to scan QR codes on mannequins and apparel to see sizes and colors that are available to purchase in-store.

Staying digital, customers can also send merchandise on display to a personal fitting room through the app – freeing customers of carrying merchandise and shooting product through tubes all over the store. There are no cash registers in the store, Nike Instant Checkout, available by app, allows shoppers to select an item, scan a barcode, and pay with a saved credit card. The app does more than help customers, it also uses geo-fencing technology synced to the perimeter of the store, so that when a shopper enters it immediately switches to the store’s interface system and begins collecting data. While shoppers roam, the app tracks behaviors that allow Nike to see how shoppers interact with the merchandise and services. This gives the brand insights into how it can provide a more personalized experience.

Personalization, a theme that has been a part of the brand’s previous store concepts, is another highlight of the flagship’s experience. At the new and improved sneaker bar, shoppers can create unique products by dip-dyeing, printing, embroidery, adding patches, etc. The bar also includes a variety of laces, zippers, and tongue tags. In less than an hour, a customer can have a fully customized sneaker designed and ready for pick-up in 2-7 days. The store was designed to have responsiveness both digitally and physically, from six-levels of modern, industrial design to a fully integrated tech system that creates a seamless shopping experience the House of Innovation 000 flagship store is not only changing the way Nike customers shop but pushing the limits of retail in every way.

Business of Furniture: NELSON Worldwide Repositions Colonial Warehouse in Minneapolis with New Lounge Amenity

Read more with Business of Furniture here.

Building Enclosure: IMPs Add Architectural Flair to Smith Brothers Farms’ New Washington Facility

Smith Brothers Farms, a Northwest leader in home-delivered organic and gourmet foods, recently expanded to a new facility in Federal Way, Washington, to accommodate its rapid growth and enhance service across the region. Designed by NELSON Worldwide, the state-of-the-art facility quadruples the refrigerated space compared to the previous location and offers modern office and distribution spaces.

Read more with Building Enclosure here.

Seizing Opportunity from the Eye of the Storm

Brand Strategy is frequently de-prioritized in a bull market when market conditions are favorable. Yet, in the wake of the Covid-19 crisis, we are entering an era where businesses must explore shaping the future to their advantage. As we move past the initial crisis management, there is a significant long-term opportunity to win in the rebound phase of the recovery by charting the course forward.

For some organizations, near-term survival is the only agenda item. Over the coming months, we will bear witness to companies winning and losing. Those who survive are going to be facing a new market with fewer competitors, and a dramatically changed the business environment. We believe that companies who weigh the trends, consider shifting behavior, and focus on innovation will be well-positioned to capitalize on never before seen opportunities.

While it is impossible to know what will happen, it is possible to consider the lessons of the past to think constructively about the future.

“Innovation is not born from the dream, innovation is born from the struggle.” – Simon Sinek

FROM CRISIS TO OPPORTUNITY

What do Disney, Target, and Starbucks have in common? They all launched or successfully retrenched during steep declines in the economy.

- Recognizing that America needed a smile more than ever, Disney was founded during the Great Depression. From there, the House of Mouse has never ceased to blaze trails, innovating to deliver high-value experiences. During the early 2000’s recession, around half of first-time Disneyworld attendees signaled they would not come back due to long lines, high costs, and other pain points. Digging into the problems led directly to the invention of long-term experience update, culminating in with the launch of the Magicband – a colorful wristband device that enables guests to travel lighter, enter the parks, unlock hotel rooms and buy food and merchandise. What can we learn from the longevity of the Walt Disney Company? How might the challenges of the current situation to speed up your long-term vision? How can your brand deliver value in the new reality?

- Founded in the wake of the 1893 Panic, what is now Target has become an iconic brand with a track record of adapting to adversity and understanding their consumer. During the 2007-2009 recession, Target saw a decline in spending on “wants” vs. “needs,” to strengthen its position, they launched a new store format devoted to food along with private label brands. They also increased media spending and reaffirmed its positioning with the slogan, “Expect more, pay less.” Since the launch of the re-positioning, new format and private label brands, food has become a $1.8 billion business for Target. What can we learn from Target’s downturn brand strategy? Remain connected to your consumer’s wants and needs—and pivot in a way that doesn’t undermine your brand or your long-term goals.

- Starbucks rapidly expanded once it went public in 1992 to become the largest coffee chain in the world. During the Great Recession, it became clear the growth had distracted from making its cafes an inviting place with new products. The company shifted back to a customer focus with the rollout of “My Starbucks Idea” to secure loyal customer opinions on everything from products, services, culture, and in-store music to regain an emotional brand attachment. They implemented over 100 ideas and grew brand loyalty with a robust fan base. What can we learn from the Starbucks retrenchment? What dialogue needs to happen with your consumer/customer/user to help you see the pathway to recovery?

MAPPING A NEW REALITY

It’s clear that in a rapidly changing market, previous assumptions and accepted truths may no longer apply. You now have the rare opportunity to take an intelligent pause to reevaluate the most critical factors facing your business comprehensively. Invest time in a health checkup for your business – identifying what’s working well and what isn’t, so you’ll be able to make better-informed and more profitable decisions.

Now is the time to take stock and:

- Uncover actionable insights to understand the most complex business challenges

- Evaluate competitors, industries, and culture for actionable advantage

- Revisit your long-term brand and portfolio planning

- Analyze shifts in user behavior in the context of market changes and emerging trends

- Understand changing user needs and identify white space opportunities

RISING STRONGER

Adversity is inevitable, but a significant market disruption doesn’t have to keep you from seizing the opportunity. Strength comes from struggle, and taking a thoughtful pause for brand strategy now will help you adapt your strategic response and position your brand to win post-outbreak. Now is the ideal time to embrace a transformational next step forward.